Planning to travel or move abroad? Many travelers and expats have no idea how much international medical insurance really costs. It’s easy to underestimate healthcare expenses overseas until you’re stuck with a bill for hundreds of dollars after a simple visit. That’s why it’s necessary to understand the true cost and what your policy actually covers.

So, how much does international medical insurance cost?

The answer depends on several factors, like your destination, age, and level of coverage. In this guide, we’ll break down the typical costs and key considerations for expats and frequent travelers.

What Affects the Price of Your Plan?

Curious why international medical insurance costs can swing so widely? These are the main factors that determine how much you’ll end up paying:

Your destination

The price of healthcare is affected by the destination country you are moving ahead. For instance, if you are moving to countries like the U.S., Switzerland, or Japan, your insurance premium will reflect that because medical care is expensive there. On the other side, destinations like Thailand or Portugal usually come with affordable conveniences.

Your age and health condition

Your age plays a big role in affecting the price of the plan. For example, older travelers are considered higher risk which means higher cost of insurance.

In addition, if you have a serious health issue like a chronic condition, you will expect to pay more for comprehensive coverage. Some insurers may also exclude pre-existing conditions unless you pay extra.

Length of your stay

The longer you’re abroad, the more your policy is likely to cost. A short 10-day holiday won’t hit your wallet the same way a year-long digital nomad adventure will. That’s because longer stays increase your risk exposure.

Add-ons and optional benefits

Extras like maternity or dental can significantly bump up your premium. But depending on your plans (e.g., starting a family, needing dental care, or spending time in the States), these add-ons might be worth every penny. Always check what’s included—and what’s not—before you decide.

Type of Coverage

An emergency-only policy is cheaper, but it won’t cover routine check-ups, prescriptions, or preventive care.

If you want full access to hospitals, specialists, and follow-up treatments, full coverage is the way to go. It’s more expensive upfront but can save you thousands in the long run.

If you’re planning to move abroad, make sure to read our guide on affordable health insurance for expats.

What Do These Plans Cover?

So, what does international health insurance get you? Here’s a quick breakdown—because knowing what’s covered can make all the difference:

- Hospital stays, surgeries, and prescriptions

If you land in the ER or need major treatment abroad, you’re covered. From overnight stays to life-saving surgeries and medication, this is the backbone of any good plan. - Evacuation, check-ups, and outpatient care

Medical evacuation can cost tens of thousands—your plan should handle that. Routine doctor visits, lab work, and follow-ups? That’s where outpatient coverage steps in. - Optional extras: mental health, dental, and vision

Want therapy sessions, cleanings, or new glasses? These benefits don’t always come standard, but many providers offer them as add-ons.

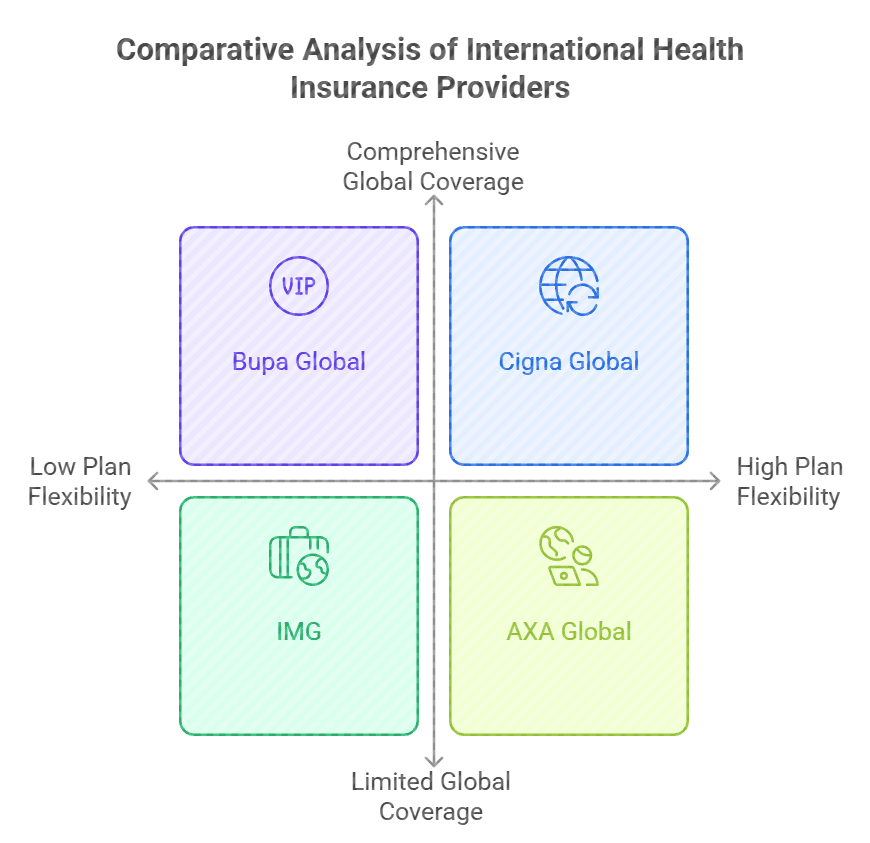

Comparison of Top International Health Insurance Providers

Here is a comparative analysis of what does international health insurance cost and what they provide;

Now that you know different health insurance providers, let’s find out how to choose the right plan for yourself.

How to Choose the Right Health Insurance Plan for You

You have to choose the right plan that matches your stay in another country. Here are some factors that you must consider to choose the health insurance plan for yourself;

Your daily lifestyle and risk factors matter a lot while choosing the plan. If you frequently travel, a comprehensive policy may be worth the cost. On the other hand, the limited and emergency coverage is enough for you if you have a stable environment with access to local care.

The next important thing is to read the fine print so you know what’s included in your plan. Each plan has its specifications. For instance, some might not cover pre-existing conditions, maternity, or mental health unless you pay extra.

Moreover, don’t get confused with travel vs health insurance. Travel insurance is great for trip cancellation and luggage loss. But it will not help you during a medical emergency abroad.

Tips to Save on Your International Health Insurance Cost

Do you want solid coverage of health without breaking the bank? Here are some smart ways to cut down your insurance costs:

- Increase your deductible – It means you will pay more out of pocket if an unforeseen condition comes. But your monthly premium will be lower.

- Skip the extras you don’t need –Keep your plan lean and focused. For example, you don’t need maternal, dental, or vision coverage, then don’t pay for it.

- Pay annually instead of monthly – You can save 5–10% of the cost if you pay annually because many insurers offer discounts if you pay for the year upfront.

- Do a thorough comparison –Prices vary between providers. To make a pocket-friendly plan, use a medical insurance comparison to find the best deal.

Conclusion

Choosing an International health insurance plan is not just a formality it’s your safety plan before moving to a new place. No matter whether you are moving as a traveler, expat, or student. By understanding travel insurance and health insurance, you can find the best plan so you can avoid costly plans.

Need help choosing the right plan? Visit our EU Info Hub for more details, expert tips, and personalized guidance based on your travel lifestyle.

FAQs

What’s the difference between travel insurance and international health insurance?

Firstly, travel insurance deals with trip cancellation, lost luggage, and medical emergencies. On the other hand, international health insurance is long-term and covers medical needs abroad. It covers hospital stays, prescriptions, checkups, and sometimes even dental and maternity care.

Can I buy a plan after I’ve left my home country?

Yes, in most cases you can. Many providers allow you to enroll while you’re already overseas. Just know that some may require a short waiting period before full benefits kick in.

Is medical insurance required in Europe?

If you’re visiting on a Schengen visa. You’ll need proof of coverage for at least €30,000 in medical expenses. For expats or long stays, having health insurance in Europe is often mandatory by law.

What’s the best provider for long-term expats?

There are some best providers such as Cigna Global, Allianz Care, and Bupa Global. Each offers strong international medical insurance plans with flexible options. Make sure to compare benefits and costs before choosing the plan. Because after all, the right choice depends on your lifestyle and destination.

1 thought on “International Health Insurance Cost: What Expats and Travelers Should Expect”